Designed by Freepik

Reference Date | Version | August 13, 2025 | 1.0 |

Keywords | Carbon Credit Trading Scheme (CCTS), Compliance Mechanism, Offset Mechanism, Carbon Market India, Bureau of Energy Efficiency (BEE), Nationally Determined Contributions (NDCs) |

Legislation(s)/Policies | (i) The Constitution of India (ii) Energy Conservation Act, 2001 (as amended in 2022) (iii) Carbon Credit Trading Scheme, 2023 (iv) Paris Agreement, 2015 |

Jurisdiction | India |

The Carbon Credit Trading Scheme is a significant step in India’s evolving climate governance framework. The Carbon Credit Trading Scheme seeks to establish the Indian Carbon Market by pricing greenhouse gas emissions and enabling the trading of Carbon Credit Certificates.

As India transitions toward a low-carbon economy, the legal and regulatory complexities surrounding such carbon markets demand a multidisciplinary approach. Aspects related to the emissions trading system, the trading of carbon credits, and compliance with the reduction of greenhouse gas emissions intensity targets require guidance from legal experts.

- Introduction

The Carbon Credit Trading Scheme (CCTS) has been introduced as part of the evolving international climate framework established under the Paris Agreement and the climate targets outlined in its Nationally Determined Contributions (NDCs). The Energy Conservation Act, 2001, as amended in 2022, provides a mechanism for developing the Indian Carbon Market (ICM) by implementing the CCTS.

This article examines the existing landscape governing CCTS in India.

- India’s Global Commitments

Globally, countries have sought to come together to take effective action against Climate Change. The Paris Agreement is an international treaty that serves as an instrument for implementing this drive to take action against climate change.

The Paris Agreement was adopted by Parties at the 21st Conference of the Parties (COP21) to the United Nations Framework Convention on Climate Change (UNFCCC) on December 12, 2015. It aims to foster and strengthen a global response to the threat of climate change with a focus on sustainable development and efforts to eradicate poverty, while also enhancing the implementation of the UNFCCC.

- Under Article 4 (2) of the Paris Agreement, member states are obligated to maintain NDCs.

- Article 5 encourages Parties to take actions to conserve and enhance sinks and reservoirs of GHG.

- Article 6 (4) of the Paris Agreement lays down the mechanism to contribute to the mitigation of GHG emissions and support sustainable development. It recognises that member states may involve the use of internationally transferred mitigation outcomes to achieve NDCs under the Agreement.

India became a signatory to the Paris Agreement on 22nd April 2016 and ratified it on 2nd October 2016. In accordance with Article 4 of the Paris Agreement, India submitted its intended NDCs to UNFCCC on 2nd October, 2015 and updated the NDCs in August 2022. These updated NDCs commit to the following:

- Reduce the emissions intensity of its GDP by 45% from 2005 levels by 2030,

- Achieve 50% cumulative electric power installed capacity from non-fossil fuel-based energy sources by 2030, and

- Create an additional carbon sink of 2.5 to 3 billion tonnes of CO₂ equivalent through forest and tree cover by 2030.

These targets underscore India’s intent to pursue climate action in a manner consistent with its developmental needs and constitutional mandate for environmental protection, as outlined in Article 48A of the Constitution of India. This Article states that the State shall endeavour to protect and improve the environment and safeguard the forests and wildlife of the country.

- Carbon Markets

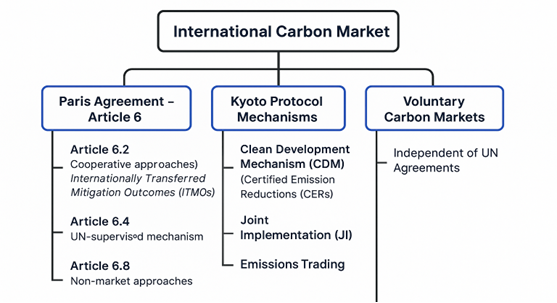

Carbon markets may operate at the domestic or international level. Article 6 of the Paris Agreement enables countries to achieve their NDCs through voluntary cooperative approaches. The development of domestic carbon markets stems from countries’ efforts to achieve their NDCs for their economy.

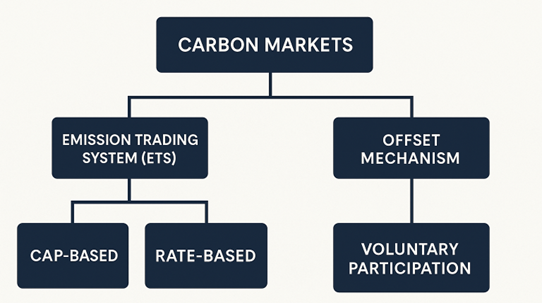

A domestic carbon market framework can be structured through a Compliance Mechanism and/or an Offset Mechanism for carbon pricing. Under a compliance mechanism, an Emission Trading System (ETS) or carbon tax may be used for pricing carbon emissions. An ETS may be either cap-based (setting an absolute emissions limit) or rate-based (linked to emissions intensity). A hybrid system may also be introduced involving a combination of ETS or a carbon tax for different sectors/ industries, depending on the jurisdiction of the carbon market. Voluntary participation is typically associated with Offset Mechanisms, especially within Voluntary Carbon Markets (VCMs).

The international carbon market enables countries and companies to trade GHG emission reductions across borders.

- Carbon Market in India – India’s Carbon Credit Trading Scheme

The CCTS in India is a mechanism designed to reduce GHG emissions through carbon pricing. The CCTS involves the utilisation of a rate-based emissions trading system, which fixes emission intensity limits for sectors and obligated entities, and will issue carbon credit certificates (CCCs) to entities that outperform these benchmark net emission intensity levels. The CCTS involves two mechanisms for decarbonisation of the economy:

- The compliance mechanism: Applicable to obligated entities and addresses the reduction of GHG emissions from energy-intensive and industrial sectors.

- The Offset mechanism: Applicable on non-obligated entities to incentivise voluntary actions and participation in the reduction of GHG emissions.

Obligated and non-obligated entities must register to participate in the ICM. Registered entities can trade CCCs through designated power exchanges, in accordance with the CCTS framework. To facilitate this, the Draft CERC (Terms and Conditions for Purchase and Sale of Carbon Credit Certificates) Regulations, 2024, propose a mechanism for CCCs trading on power exchanges.

The roles of participating entities under the CCTS are as follows:

- Obligated Entities: These are registered entities that are notified under the compliance mechanism. They have to achieve the GHG emission intensity as per the targets set and notified by the Ministry of Environment, Forest and Climate Change (MoEFCC) under the Environment Protection Act, 1986. These entities may also be required to meet other targets, such as specific energy consumption, as may be notified by the Ministry of Power (MoP) under the Energy Conservation Act, 2001. Any obligated entity will be issued CCCs for reducing their GHG emission intensity in excess of the targets set for them as per the recommendation of the National Steering Committees. Moreover, any obligated entity that fails to meet its target reduction must meet its shortfall by the purchase of CCCs from the Indian carbon market.

- Non-Obligated Entities: They are registered entities that can purchase CCCs on a voluntary basis. They can generate income by selling these credits to obligated entities seeking to meet compliance requirements, thus creating a secondary demand-driven market.

- Key Regulatory Bodies

The CCTS establishes four key regulatory bodies:

- The National Steering Committee holds primary governance by setting GHG emission targets for obligated entities and keeps oversight of the Indian carbon market.

- The Bureau of Energy Efficiency (BEE) shall act as the Administrator of the Indian Carbon market, responsible for developing rules and issuing CCCs based on the Steering Committee’s recommendations.

- The Grid Controller of India Limited will serve as the Registry for the Indian carbon market.

- The Central Electricity Regulatory Commission (CERC) regulates trading activities within the Indian Carbon Market.

- Regulatory and institutional framework enabling CCTS

S.no | Title | Description |

1. | Accreditation Procedure and Eligibility Criteria for Accredited Carbon Verification Agency. | This provides the minimum eligibility requirements and procedures for accreditation that any agency must fulfil to obtain accreditation for performing activities as an accredited carbon verification agency, undertaking validation and/or verification activities under ICM as specified by the Bureau from time to time. |

2. | Approved Sectors in Compliance Mechanism. | The current Perform Achieve and Trade Scheme will be transitioned gradually for the relevant sectors and entities to the compliance mechanism under CCTS. Nine approved sectors, which are to be considered for gradual transition under CCTS, are:

|

3. | Approved Sectors in Offset Mechanism under CCTS by the Central Government. | The approved sectors in the offset mechanism under CCTS by the Central Government are: Phase 1: b. Industries c. Waste handling and disposal d. Agriculture e. Forestry f. Transport Phase 2: b. Fugitive Emissions c. Solvent use d. Carbon Capture, Utilisation, and Storage (CCUS) |

4. | Draft notification on Central Electricity Regulatory Commission (Terms and Conditions for Purchase and Sale of Carbon Credit Certificates) Regulations, 2024. | These Regulations are applicable to CCCs offered for transactions on Power Exchange(s), including contracts in CCCs in accordance with the provisions of the Power Market Regulations. The CCCs shall only be dealt with through the Power Exchanges, and as per the provisions of the Electricity Act, 2001, the Environment Protection Act, 1986, the CCTS, 2023, and these Regulations. There shall be two market segments in e Power Exchanges, the Offset Market for CCCs of non-obligated entities and the Compliance Market for CCCs of obligated entities. |

5. | Draft notification on Greenhouse Gases Emission Intensity (GEI) Target Rules 2025. | Section 11 of the CCTS, 2023, lays down the compliance mechanism for sectors and obligated entities covered. Section 11(4) of the Scheme requires obligated entities to achieve GHG emission intensity (GEI) targets. The GEI Draft Rules provide that failure to comply with the GEI targets by an obligated entity, CPCB, will impose Environmental Compensation on such obligated entity for the shortfall in the compliance year, which will be equal to twice the average price at which the carbon credit certificate is traded during the trading cycle of that compliance year. |

- Conclusion

The ICM is on the horizon, but not yet operational. To ensure the timely and effective operationalisation of ICM, certain critical steps must be prioritised. Parts of the framework to enable the CCTS, such as accreditation procedures, sectoral coverage and trading regulations, have been notified, however, CCTS’s full implementation is pending. The absence of a list of accredited carbon verification agencies, implemented GHG emission intensity targets, and rules for the sale and purchase of CCCs continues to withhold the operationalisation of the CCTS. The trading of carbon credits under the compliance mechanism is expected to begin in 2026-27. Countries like China and Indonesia have already operationalised their carbon markets, and this slow rollout is holding India from being a leader in climate change action. India must take prompt action to ensure it remains competitive in this emerging carbon pricing landscape.

Additionally, while carbon credits and carbon credit trading are important market-based mechanisms for incentivising emission reductions, they are not a substitute for actual emission elimination at source. In an ideal scenario, the focus should be on capturing carbon dioxide emissions at the point of generation, and then securely transporting, storing, or utilising them through the Carbon Capture, Utilisation, and Storage (CCUS) technologies.

As CCUS technology advances, we must not overlook the legal, regulatory, and policy foundations that will ultimately determine its success. Without a clear, robust, and future-ready policy framework, even the most promising technologies risk falling short of their potential. Now is the time to put that framework in place—to ensure CCUS is deployed safely, efficiently, and with full accountability.

Founded in 2003 by Divjyot Singh and Suniti Kaur, Alaya Legal takes pride in its boutique practice, encompassing Litigation & Arbitration, Corporate and Commercial, Energy & Sustainability and Information Technology (IT) and Artificial Intelligence (AI). The firm offers tailored solutions to its clients to align with their growth objectives by leveraging its expertise and experience in these sectors.

If you are interested in related topics such as carbon markets, emissions trading, or similar energy law aspects, reach out to our legal firm in Gurgaon, which holds expertise in transactions, documentation, and compliance with environmental laws and regulations. Our Energy & Sustainability Practice Group would be happy to understand your specific requirements and work with your team to address various issues related to these matters. Please feel free to contact us for more information on how our legal firm in NCR can help.